According to NCVO statutory funding accounts for around 60 of the charity sectors total income and yet approximately 75 of voluntary organisations do not receive any state support at all. And employers contribute the employer portion of Social Security and Medicare taxes.

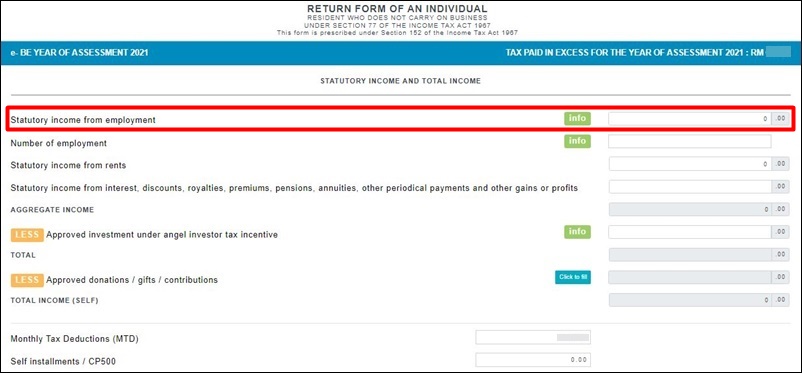

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Statutory employees are usually salespeople or other employees who.

. Assessable income is your ordinary income and statutory income. The goods sold must be merchandise for resale or supplies for use in the buyers business operation. The IRS classifies only four different categories of an employee who can be considered statutory.

This means that there are charities that may qualify for statutory funding but arent receiving it. This type of employee is usually considered to be someone with less control over their work. A full-time traveling or city salesperson who works on your behalf and turns in orders to you from wholesalers retailers contractors or operators of hotels restaurants or other similar establishments.

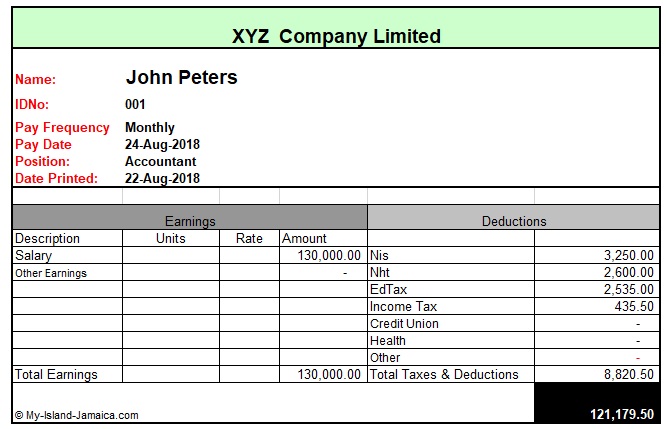

Statutory Payments has the meaning. A driver who distributes beverages other than milk or meat vegetable fruit or bakery products. Jamaican Tax Guides No Votes Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given.

Statutory income is referred to in the explanatory memorandum in the following terms. 12 Interpretation a In this Agreement unless the context requires otherwise any express reference to an enactment which includes any legislation in any jurisdiction includes references to. A statutory employee is defined by the law as an employee who works for a business but the employer is not required to withhold taxes from their earnings.

Statutory Net Income means with respect to any Insurance Subsidiary for any computation period the net income earned by such Person during such period as determined in accordance with SAP currently Underwriting and Investment exhibit Statement of Income Line 16 of the Annual Statement-1997. Statutory Income is also reffered to as Take Home Pay as it is the amount of money you take home after all deductions. Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act.

A statutory employee is a cross between an independent contractor and an employee. It calculates Social Security tax at 62 percent of gross income up to 106800 yearly and Medicare tax at 145 percent of all gross income. The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay.

Ordinary concepts of income that have been. Section 10-5 of ITAA 1997 accessible from the ATO website includes a table which specifies the sections which include statutory income in assessable income. Specifically included in assessable income.

Statutory income means statutory income ascertained in accordance with this Act. A class of employee that is permitted to deduct work-related expenses on Schedule C instead of Schedule A. Statutory income means the pre -tax statutory income of the Borrower s Consolidated Insurance Subsidiaries excluding capital gains and losses but adjusting the amount of.

If workers are independent contractors under the common law rules such workers may nevertheless be treated as employees by statute statutory employees for certain employment tax purposes if they fall within any one of the following four categories and meet the three conditions described under Social Security and Medicare. Annual turnover is the total ordinary income that you derive in the income year in the course of running your business. Statutory income means the pre -tax statutory income of the Borrower s Consolidated Insurance Subsidiaries excluding capital gains and.

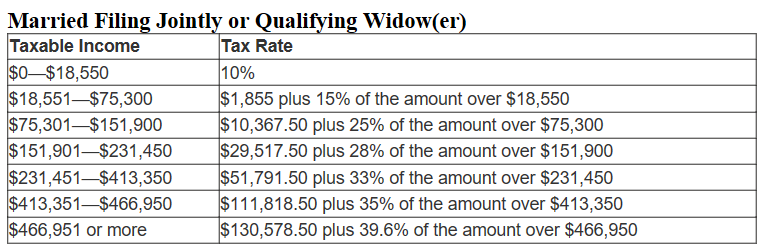

Statutory Payments means the payments required to be made to Government Authorities in terms of Applicable Law. The basics of statutory funding. The statutory tax rate is the rate imposed by law on taxable income that falls within a given tax bracket.

Statutory order means an order having legislative effect. Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act. When we say turnover we mean aggregated turnover.

A statutory employee is an independent contractor who qualifies for employee treatment. What does it mean and what is the difference between Gross Pay and Net Pay. Statutory income is income that is not part of the income from an hourly or salary job.

Stock in trade of a chargeable. Based on 1 documents. The definition of associate is very broad.

Statutory income means the pre-tax statutory income of the Borrowers Consolidated Insurance Subsidiaries excluding capital gains and losses but adjusting the amount of investment income derived from tax-exempt securities by dividing the nominal amount of such tax-exempt investment income by a fraction. Jamaica Tax - Statutory Income. It computes state income tax withholding according to the respective revenue agencys policies.

Tax terms clearly explained to make tax simple. Employers withhold the employee portion of Social Security tax and Medicare tax from a statutory employees wages. Some types of statutory income are commission lump sum payments for termination of a job royalties and.

Statutory income is an amount the law specifically includes in assessable income for example section 160ZO of the Income Tax Assessment Act 1936 includes net capital gains in assessable income. Statutory employee definition. Statutory income are amounts outside the.

The effective tax rate is the percentage of income actually paid by an individual or a company after taking into account tax breaks including loopholes deductions exemptions credits and preferential rates. If an amount is not ordinary income it may be statutory income. Or who picks up and delivers laundry or dry cleaning if the.

However the employer is required to withhold Medicare and Social Security tax from their wages.

Chapter 14 Take Home Pay Required And Taking Statutory Deductions Into Account In Living Wages Around The World

Definition Of The Statutory Tax Rate Higher Rock Education

Definition Of The Statutory Tax Rate Higher Rock Education

How To File Your Taxes If You Changed Or Lost Your Job Last Year

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Adjusted Gross Income Agi Definition Taxedu Tax Foundation

Ctos Lhdn E Filing Guide For Clueless Employees

Effects Of Income Tax Changes On Economic Growth

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Residual Income Definition Formula How To Calculate

Exempt Income Meaning Types How It Works In Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

1040 Statutory Employees Schedulec Schedulese W2

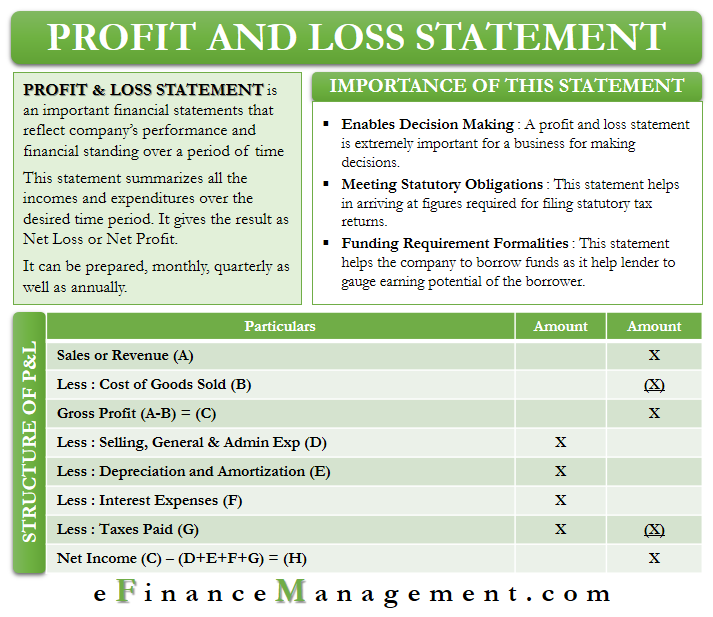

Profit And Loss Statement Introduction Importance Structure Analysis

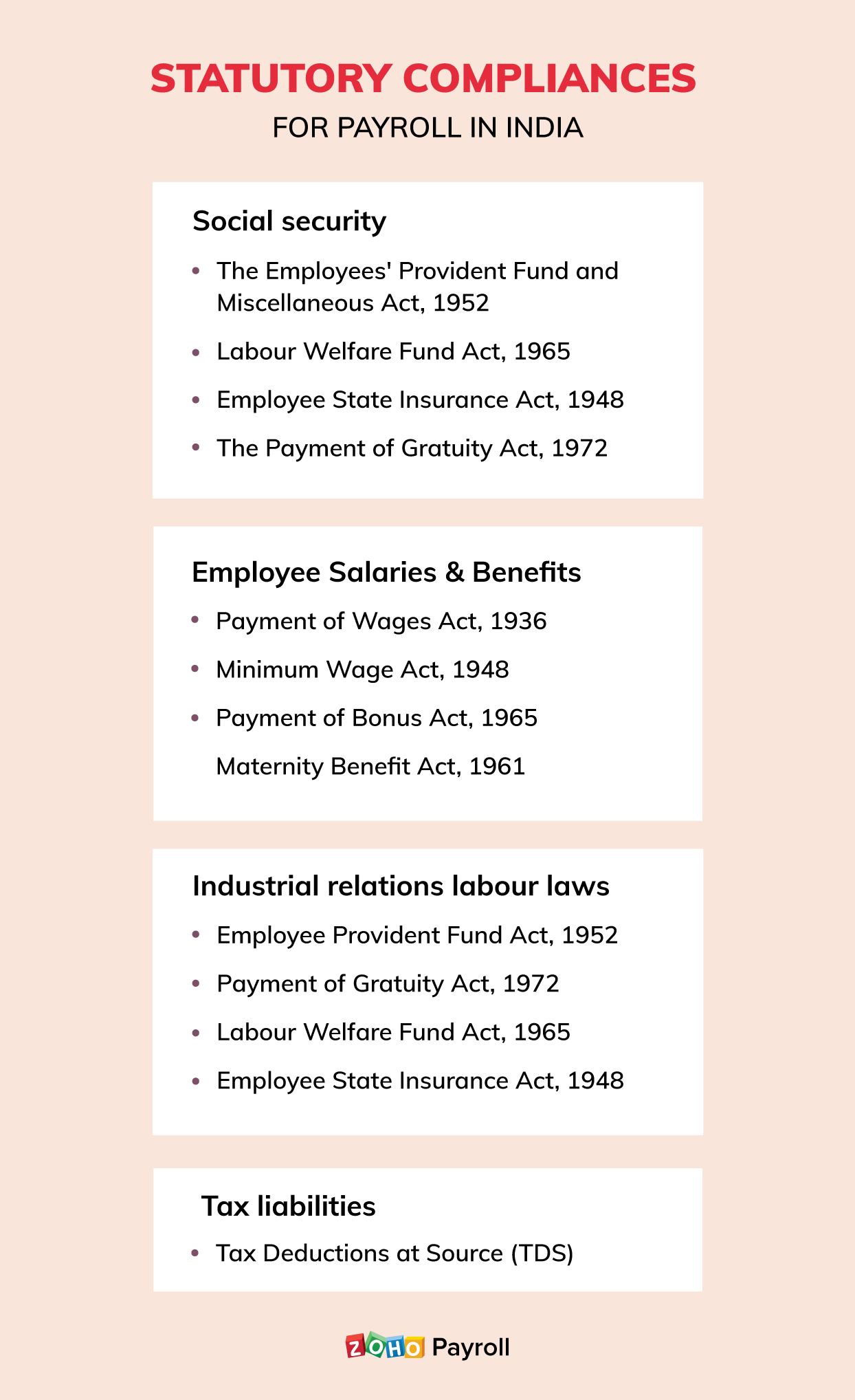

Statutory Compliance Guide To Payroll Compliance In India Zoho Payroll

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To File Your Taxes If You Changed Or Lost Your Job Last Year

What Are Statutory Deductions In Jamaica